«Medicata» — the eRx platform with all-in-one app for prescribed medications

We’ve re-invented eRx in Russia

MY ROLE

Managing partner

June 2018 - July 2022

My duties and responsibilities: product strategy, team building, vision, and implementation, fundraising, business development and operations, government relations, sales and customer service.

- As a leader, I hired and effectively managed a diverse team of 50 members, spanning software development, sales, marketing, finance, legal, support, and deployment, ensuring a cohesive and productive work environment.

- I used my expertise in product management, operations, and sales to deliver in 12 months an e-prescription platform.

- I successfully secured investments worth 2.5 million USD through negotiating strategic partnerships.

- The platform connected more than 1500 pharmacies and 100 clinics.

- In 2019, the project I led was honored with a prestigious national award for the best IT product in healthcare, a testament to our team's dedication and innovation.

Project timeline

Start - May'18

MVP - April'19

PoC - in Belgorod, May-July'19

Rollout in Belgorod region Dec'19 - Mar'20

Expansion June'20-Dec'21

Investments, Dec'20

eRx for private clinics May '21

End, July '22

The Start

Damir has invited me to meet with his longtime partner Sergey, an entrepreneur, venture investor, one of the founders, top manager of IBS Platformix, and founder of Laboratory Element, a company focused on IT in healthcare.

They presented the idea, and I saw a lot of potential to reshape the present practice and make prescribing and treatment much easier and more effective. I jumped in the opportunity without a doubt.

Russia's healthcare in 2018

Outpatient medicine in Russia was ~85% state-owned clinics and ~15% private sector.

Outpatient treatments were covered by compulsory health insurance, and Outpatient Rx medications were covered for limited diagnoses and a limited set of medications. Pharmacy market - 15% were insured medications, 85% retail (out of pocket) medications.

Outpatient treatments were covered by compulsory health insurance, and Outpatient Rx medications were covered for limited diagnoses and a limited set of medications. Pharmacy market - 15% were insured medications, 85% retail (out of pocket) medications.

Rx prescriptions are regulated by law and must be issued on paper blanks, but, in real life, just only 3-5% of all medications were prescribed on the blanks (except state-insured medications, which were on the blanks).

There was a country-wide common practice of the acceptance of any piece of paper with the name of medication or INN by pharmacies as a legal prescription. Moreover, there was no problem buying antibiotics or other Rx without a prescription at all (excluding the list of restricted and forbidden-to-sell medications).

There was a country-wide common practice of the acceptance of any piece of paper with the name of medication or INN by pharmacies as a legal prescription. Moreover, there was no problem buying antibiotics or other Rx without a prescription at all (excluding the list of restricted and forbidden-to-sell medications).

Problems we wanted to solve

Our team of Sergey, Damir, Alexey – founders, Alexander – CTO and I figured out 3 major issues to focus on

- 1Typos and mistakesUp to 10% of prescriptions weren’t recognized and served by pharmacist due to errors or bad hand writings.

- 2Lack of up-to-date informationA ton of non-compatible and outdated data sources of medications - hard to rely on and check medications interoperability, availability, and prices.

- 3Poor medication adherenceUp to 60% of patients didn't follow prescriptions, which regularly caused relapses and side effects, costing hundreds of millions for the economy and healthcare every year.

Competitors

There was no working eRx system in Russia, statewide or regional.

We ruled out all claims about the implementation of an electronic system for prescribed medications.

My research found all of them worked as record-keeping systems, only providing no patient and pharmacy-related services

We ruled out all claims about the implementation of an electronic system for prescribed medications.

My research found all of them worked as record-keeping systems, only providing no patient and pharmacy-related services

eRx out of Russia

I studied 10 existing eRx projects, SureScripts in the USA, eRx Script Exchange in Australia, and the prescription system in Finland was the most successful among them.

We incorporated NCPDP 7.0 as standard for data exchange between clinics and pharmacies

We incorporated NCPDP 7.0 as standard for data exchange between clinics and pharmacies

Business model

I created several go-to-market strategies and financial models. After thorough analysis and discussions, we decided to take a state-oriented approach—it seemed reasonable given the majority of state-owned clinics.

Our decision was not only based on our own experiences, but also on insights gained from previous projects. We learned that the traditional 'build-sale-support' approach is not the path to solving the problems we aim to address.

Our decision was not only based on our own experiences, but also on insights gained from previous projects. We learned that the traditional 'build-sale-support' approach is not the path to solving the problems we aim to address.

We needed a different model with more control and a broad range of monetization. State-Business Partnership (SBP) was successful in other sectors like construction and road works but not IT due to different reasons, including corruption, fear of IP as a capital investment, lack of knowledge, and resistance to any innovation. We decided to take a risk because we felt that was the way to implement it in the way we wanted it and under our control.

We figured out several monetization options. The first one was a subscription-based model, where pharmacies paid a monthly flat rate or by transaction.

We figured out several monetization options. The first one was a subscription-based model, where pharmacies paid a monthly flat rate or by transaction.

MVP&POC

In July 2018, I've managed to convince the Head of IT of Belgorod Region to do a PoC and try to implement our business model.

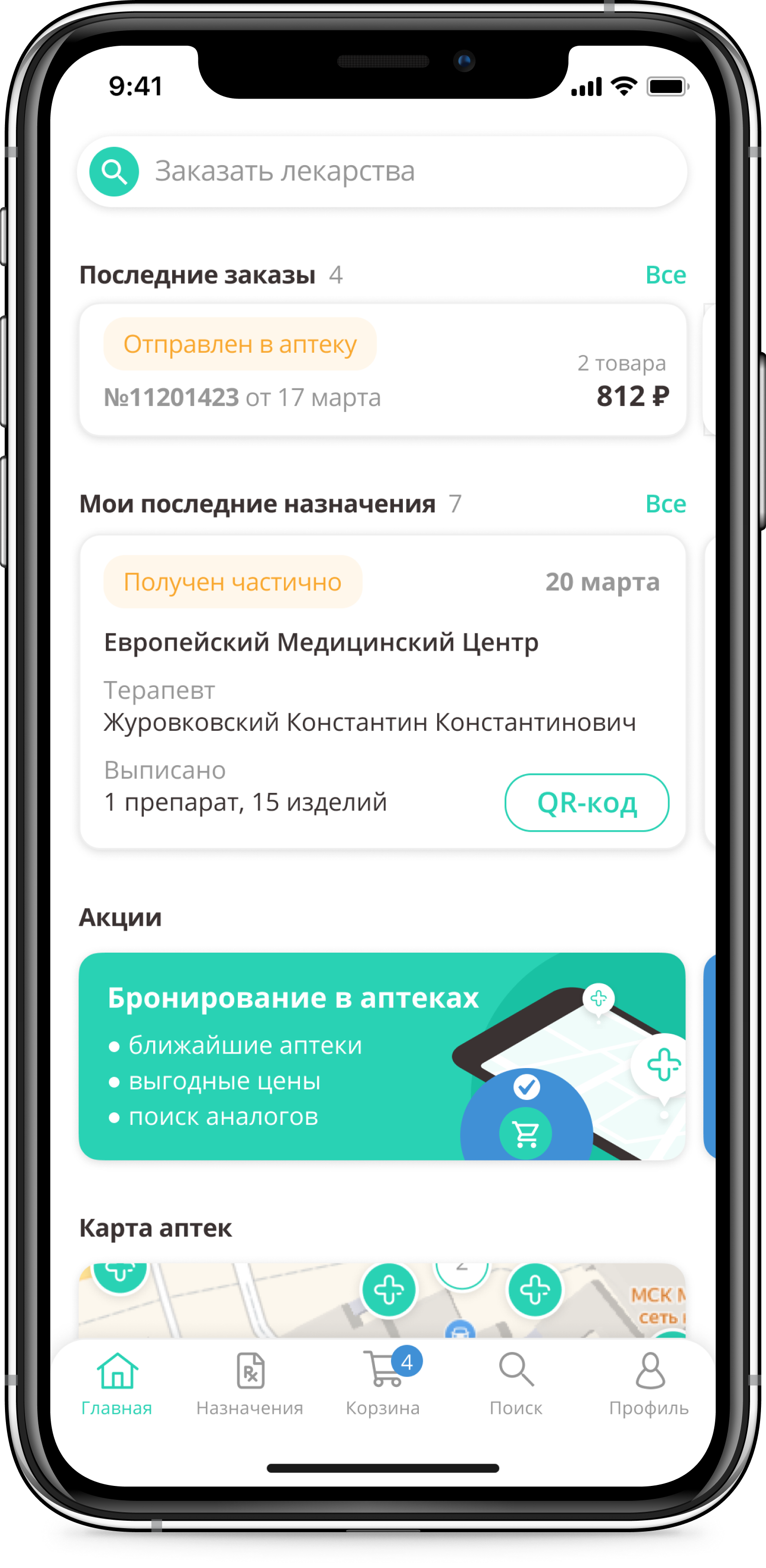

We built MVP in the next 8 months and entered the PoC project with 1 clinic and 4 pharmacies in April-May of 2019.

We built MVP in the next 8 months and entered the PoC project with 1 clinic and 4 pharmacies in April-May of 2019.

After 3 months of PoC, we’ve seen good traction in the prescriptions issued and app downloads. Belorod region authorities saw a lot of opportunities for patients and healthcare system, they approved further steps and initiated a tender, which one we won in September.

Rollout

Our team has managed to connect 100 pharmacies and 60 clinics in one month in the Belgorod region and has taught 300 practitioners and pharmacists.

We've launched several PR and promo campaigns to draw attention to the platform and mobile app

We've launched several PR and promo campaigns to draw attention to the platform and mobile app

Nearly 50% of all pharmacies were connected across the region in 3 months. Everything looked perfect from a technical point of view - all systems have been integrated and worked fine. But key indicators - eRx issued, eRx usage in pharmacies, has been less from projected targets. I've started digging - conducted meetings with practitioners, and pharmacists, gathered focus groups with patients, and figured out a list of issues.

Problems and challenges

- 1Pharmacies

- Old habits - have no interest in using technology over the usual way - pharmacist has been continued to ask patients what medication needed instead of scanning QR code from the mobile app or landing page

- Fear of competition with other pharmacies - business owners expressed a strong fear of providing availability and pricing data to the platform

- 2Authorities

- Despite the goal of the National Health Program - to have eRx national wide in 2022, health authorities demonstrated the absence of willingness to change the regulations to make it simpler, clearly, and strictly for eRx usage.

- Bureaucratization and fear of the use of State-Business Partnership (SBP) over well-known purchasing models.

- No practical interest in the out-of-pocket (paid by patients) issued prescriptions

- 3Clinics

- Old habits – strong commitment to handwritten prescriptions

- Luddism – sabotage of any new tech.

- Fear of punishment in case of wrong treatment or mistake

- 4Patients

- Lack of potential to learn new in a stressful environment in the clinics

- Old habits - prefer to go to familiar pharmacies and buy medications using paper prescription

Covid-19 Era

SARS-CoV-2 caught the world's attention in three months after rollout. We've tried to adapt and help - built a new service layer and integrated it with Telemed apps and government service Gosuslugi just in one month. Service was used in two regions - in Moscow and Belgorod Districts, all patients were able to get distant doctor's consultations and prescriptions.

Invented and implemented remote approval for existing medication courses.

Invented and implemented remote approval for existing medication courses.

It was a huge help for the clinics - we learned that 30% of visits in clinics had one goal only - to extend existing prescriptions. Remote renewal helps in any pandemic or epidemic, like flu - decreasing spread by ruling out unnecessary visits. After half a year, we succeeded in persuading the healthcare authorities and we had implemented this service in the Belgorod region.

Despite the extreme volatility - we counted 30 resignations of regional heads of healthcare departments in 2020, we managed to launch PoC in 7 regions. Prepared and approved legislative documents for eRx usage in 9 regions.

Despite the extreme volatility - we counted 30 resignations of regional heads of healthcare departments in 2020, we managed to launch PoC in 7 regions. Prepared and approved legislative documents for eRx usage in 9 regions.

eRx online sales

Online sales and delivery of Rx medications were prohibited in Russia, despite of enormous rise of online sales of other goods. Authorities had a lot of concerns about medication transportation, safety, and illegal use because of the inability to validate prescriptions.

Our team has offered a solution based on our platform and tested it with a well-known online retailer. The eRx validation service eliminated any risk of unauthorized sale of Rx medications and provided full transaction transparency for all participants and authorities.

We allied with pharmacy chains, professional associations, and on-line retailers (Ozon, Yandex, SojuzPharma, Zdravcity, and others) and prepared all legislative documents for a PoC in several regions.

We allied with pharmacy chains, professional associations, and on-line retailers (Ozon, Yandex, SojuzPharma, Zdravcity, and others) and prepared all legislative documents for a PoC in several regions.

Fundrising

The partnership with a major player was our key objective from the beginning. Our project with nationwide scale potential required strong financial and GR support. We were looking for enterprises - insurance companies, healthcare IT, pharmaceuticals – countrywide chains, distributors, not excluding investment funds. The 20 potential investors were pitched in 8 months (November 2019 to July 2020). Most of the potential investors came from Sergey’s contacts, I have managed to attract the attention of two corporations who made us offers, in January and in August 2020. We signed a Term Sheet with Atlas Investments, a Vadim Yakunin (Protek Group, #1 Pharma distributor and largest pharmacy chain in RU) controlled company in late August and closed a deal on 24th of December 2020.

One of the potential investors, a state-owned enterprise, approached us with an investment offer in mid-February 2021. It looked like a perfect blend for us – two shareholders, both leaders in important sectors – one in B2B, the other in B2G, should give us the desired strength in GR and finance. It should have been, but it turned out as a bizarre process between corporative lawyers fighting for future gains and mitigating unrealistic risks. After 9 months of negotiations, a ton of meetings, emails, calls, the Term Sheet was approved in an 8-hour-long in person meeting with a group of lawyers and decision makers. Then I spent another 7 months in the similar process - had trying to find balanced terms for all parties about future control and risk mitigations. My focus was too bent on this process, and I began feeling like a lawyer at some point. Meanwhile, two things happened in February-March of 2022 that made a significant impact on both parties and the process:

1) The potential investor changed his negotiation team entirely, and 2) Investments froze after the 24th of February; these two events led to the deal falling apart in May 2022.

Talks with 2 other investors in May-June left us empty-handed.

1) The potential investor changed his negotiation team entirely, and 2) Investments froze after the 24th of February; these two events led to the deal falling apart in May 2022.

Talks with 2 other investors in May-June left us empty-handed.

The Fall

We opened '22 with seven regions in PoC, 1500 pharmacies, and 15 integrations with HMS, EHR, and PMS. We focused heavily on the private clinics market in Moscow—more than 100 clinics were in our sales pipeline.

The ideal storm hit us two months after the New Year celebration:

Private clinics put on hold all their budgets, regional state partnerships stalled, investors' negotiations slid aside – everything changed – new tasks, topics, and problems were raised.

Our team has been forced to change our tools: e-mail, task management systems, help-desk systems, file storage, chats, word processors, spreadsheets - everything except the accounting system. We'd let our team choose where they want to work – remotely or in the office; half of the team decided to work remotely. We'd double down on team communications and relationships, motivating and helping to work and live in such a stressful environment. Despite the efforts of the team, we've faced a grumpy reality – lack of revenue, extreme uncertainty in the market and overall situation, and failed fundraising. All these led shareholders to the one decision – to close the project entirely at the end of July 2022.

The ideal storm hit us two months after the New Year celebration:

Private clinics put on hold all their budgets, regional state partnerships stalled, investors' negotiations slid aside – everything changed – new tasks, topics, and problems were raised.

Our team has been forced to change our tools: e-mail, task management systems, help-desk systems, file storage, chats, word processors, spreadsheets - everything except the accounting system. We'd let our team choose where they want to work – remotely or in the office; half of the team decided to work remotely. We'd double down on team communications and relationships, motivating and helping to work and live in such a stressful environment. Despite the efforts of the team, we've faced a grumpy reality – lack of revenue, extreme uncertainty in the market and overall situation, and failed fundraising. All these led shareholders to the one decision – to close the project entirely at the end of July 2022.

I am thankful to the entire talented team at Medicata, as well as the founders, investors, partners, and clients, for four engaging and fruitful years working on the project.

Failures and mistakes

- 1Too broad approachProbaly, we should have been focused on a B2B market, adopt full cycle in couple clinics and one-two networks chains in Moscow to achieve sustainable revenue figures before scaling

- 2Quick hireI did not pay enough attention when we hired the head of B2B sales, my interview was too short and my judgment was quick - I had trusted good recommendations from internal and external and solid track record.

- 3Slow fireI tried to help evolve and improve of the Sales leader and sales team for 5 months and failed after the end. I should have stopped that much earlier.

Key takeaways

- 1Trust your gut moreWhen making decisions, pay closer attention to your feelings. If rational thinking and analytical data suggest a certain decision, but you feel internal discomfort, take a moment to reassess, regardless of any recommendations, advice, analytical reports, or established business practices.

- 2Be more effective with corporate lawyersDo not waste time to persuade lawyers who do not have the necessary experience, do not understand the nature of the business, and pursue only one goal - to ensure the absence of any risks.

- 3Don't overestimate gov willingness and expertiseNeed to have a Zero level of expectations for an authority for their knowledge, understanding, and willingness to do anything. It will help a lot to make the correct estimation and prevent unnecessary resource waste

MEDIA

Press, app UI, promos, videos